Introduction of LOH

The insurance covers the total or partial loss of income or financial loss incurred as the result of the loss of use of a vessel following an incident that is covered under the Hull and Machinery policy e.g. breakdown of machinery, collision, grounding, stranding, striking FFO etc. As per the most well-known and usual market wordings Norwegian Hull Plan, it covers the loss of income:

- because the ship has stranded,

- because the ship is prevented by physical obstruction (other than ice) from leaving a port or a similar limited area, or

- as a consequence of measures taken to salvage or remove damaged cargo, or

- as a consequence of an event that is allowed in general average pursuant to the 1994 York Antwerp rules.

The time loss is calculating for the time from the happening of the incident, and the time spent for repairing in shipyard, until the ship can resume the voyage or activity.

The insurance will also cover the extra costs (sue and labour) incurred in connection with temporary repairs and in connection with extraordinary measures taken in order to avert or minimize loss of time covered by the insurance, insofar as such extra costs are not recoverable from the hull insurer.

In general, the cover is limited at 90 days or 180 days, in which the deductible will be usually 14 days depending on the fleet size and also the type of incident.

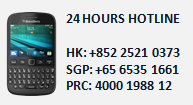

Both The Strike Club and Lloyd’s Market offers this type of cover, depending on the age of the vessels.

The Loss of Hire would also extend to cover the off hire period caused by War Risks. A small annual premium will charge to cover the war loss of hire when the vessels trade worldwide except the war zone. Assureds are warranted to declare all breach voyages to the insurers when their vessels trade to the war zone which is listed on the updated “Joint War Committee Listed Areas”. Additional premium will be charged to maintain the war LOH cover in the war zone.